Transaction Management

Welcome to the Transaction Management section.

In the Transaction manual, you'll find comprehensive guidance on understanding transaction details in the transaction module and instructions on performing various actions.

Types of Transactions

Transaction types differ depending on the integration method chosen by each merchant. Each type carries its own significance and repercussions, influencing financial records and customer relations.

It's important for users of Vendo Backoffice users to understand each transaction type because it helps to manage tasks efficiently, track when payments are made, and effectively deal with billing questions from your customers.

Difference Between an Upgrade and a Change Offer

An "Upgrade" transaction is primarily used to convert trial subscriptions into full subscriptions. This can happen automatically at the end of a trial period, transitioning the customer to a full subscription without additional action. However, there is also an "Instant Upgrade," which occurs when a customer initiates the upgrade during the trial period to access content not included in the trial. This instant upgrade is driven by the customer’s desire for immediate access to additional features or content.

On the other hand, a "Change Offer" transaction (considered a rebill) is used to modify the terms of an existing membership, such as changing the subscription duration or price. For example, a change offer might include a link for customers to upgrade from a monthly to a yearly subscription or downgrade from a yearly to a monthly one. This allows customers to adjust their subscription to better suit their needs.

Both upgrade and change offer transactions serve distinct purposes in managing memberships and providing customers with options to tailor their subscriptions.

Difference between pre-authorization, capture and verification

- A pre-authorization on a card, also known as a pre-auth or authorization hold, is a process where a specific amount of funds is temporarily reserved on a customer's credit or debit card. This ensures that the card is valid and that there are sufficient funds or credit available to complete a transaction at another time in the future.

- A card capture is a process that follows payment authorization. At this stage, the transaction is completed, and the funds are deducted from the customer's account. A capture can happen with or without a pre-auth.

- Verification refers to the process of confirming the customer’s identity and/or payment details. This process helps to ensure the legitimacy of the transaction and reduces the risk of fraud. There are several types of verification methods used in different payment systems, e.g. 3DS, phone verification, Captcha, etc.

The difference between a verification versus authorization

Verification and authorization are two crucial steps in processing a payment, with each serving different purposes to ensure the transaction's legitimacy and security.

When the customer pays with their credit card, both 3DS verification and S2S Payment Authorization need to occur. Payment capture occurs during the S2S Payment and 3DS Verification confirms that the user is the rightful owner of the credit card. Passing the 3DS Verification process does not guarantee that the credit card has sufficient funds to cover the transaction. In other words, verification can be successful, but S2S Payment still fail (the user will be never charged) if there are insufficient funds.

When the customer pays with PIX, crypto or Pay by Bank, the 3DS Verification process also captures the payment. In such cases, there's no need for the S2S transaction. However, for consistency in reporting, it's still necessary to create an S2S payment.

NOTEFor hosted pages, PIX, Crypto or Pay by Bank don’t have verification. We directly create the Signup transaction on S2S because we need the end-user present to connect to their bank (PIX or Pay by Bank) or their virtual wallet (Crypto).

Policies for partial or full refunds

Clearly outline refund policies in your terms and conditions, specifying eligibility criteria for full or partial refunds and how partial refunds are calculated. Make these policies accessible on your website and during checkout. Communicate with customers before issuing refunds to address concerns, and educate them on maximizing subscription benefits to reduce refund requests.

Set reasonable refund windows (e.g., 14–30 days) and use prorated calculations for partial refunds after a minimum usage period. Monitor refund patterns to identify trends and detect abuse. Offer alternatives like subscription pauses, credits, or discounts to retain customers.

Leverage technology to streamline refund tracking, detect fraud, and collaborate with payment processors to reduce chargeback risks. Train customer support teams for consistent, professional handling of refund requests and ensure compliance with local regulations to maintain trust and minimize losses.

Failed Payment Errors

When a transaction fails, it's crucial for merchants to promptly investigate the issue by checking the error message associated with the failed transaction. Addressing failed payment errors quickly enhances operational efficiency and boosts customer satisfaction.

Repurchased vs Reactivated

The transaction type "Repurchase Sign-up" refers to a customer renewing an expired membership. This repurchase is a 1-click transaction, enabling users to easily "reactivate" their expired subscriptions. Merchants can utilize this transaction type via the Vendo Customer Portal or in email campaigns.

Reactivation is an action taken by the customer, allowing them to reverse a subscription cancellation, provided the subscription has not yet expired.

Locating a Merchant Reference in Vendo

A "Merchant Reference" is a unique identifier assigned by a merchant to each transaction. It allows the merchant to easily track and identify specific transactions, orders, or customers within their own system. This reference can help with tasks like reconciliation, reporting, and tracking any issues related to individual transactions or accounts.

The Merchant Reference is typically generated by the merchant’s system at the time of purchase and can be located in Vendo backoffice under transaction details (sales -> transactions).

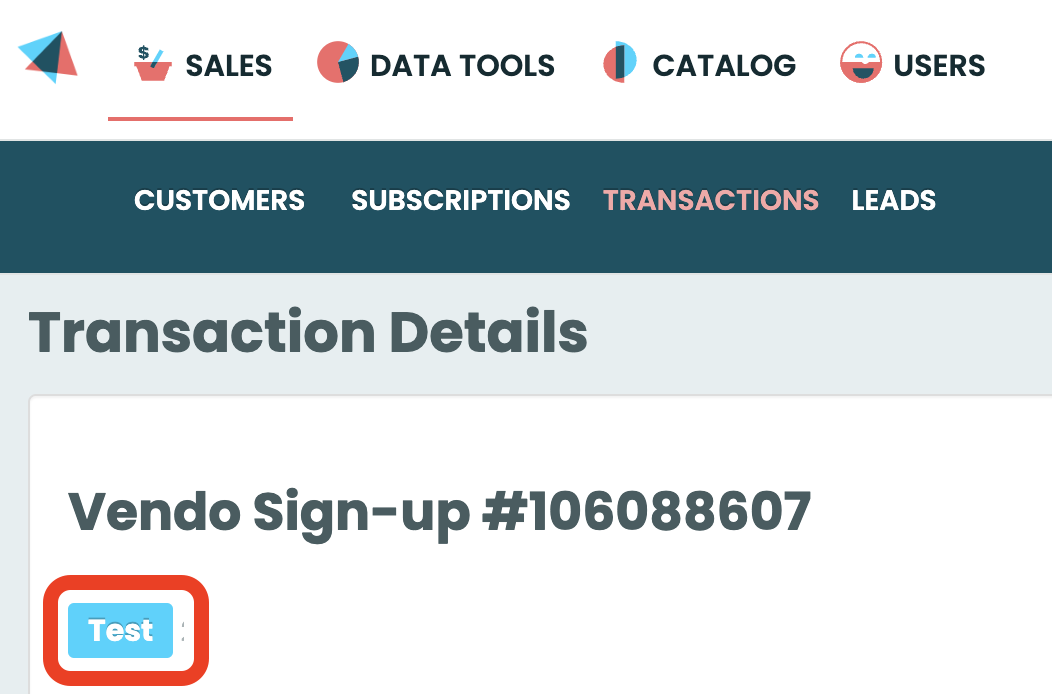

Ensure Success: Run a Test Transaction First

Running a test transaction is crucial for several reasons, as it ensures a seamless experience for both the merchant and their customers.

Here's why it's important:

- Validate Integration Accuracy

Ensures that your system is correctly integrated with the payment gateway or platform.

Confirms that API calls, postbacks, and payment flows function as expected. - Identify Potential Issues Early

Detects errors, bugs, or mismatches in configuration before customers encounter them.

Prevents disruptions in live transactions, reducing the risk of lost revenue or customer dissatisfaction. - Review Customer Experience

Allows you to experience the payment process as a customer would, ensuring it’s intuitive and error-free.

Optimizing Your View in the Sales Transactions Section

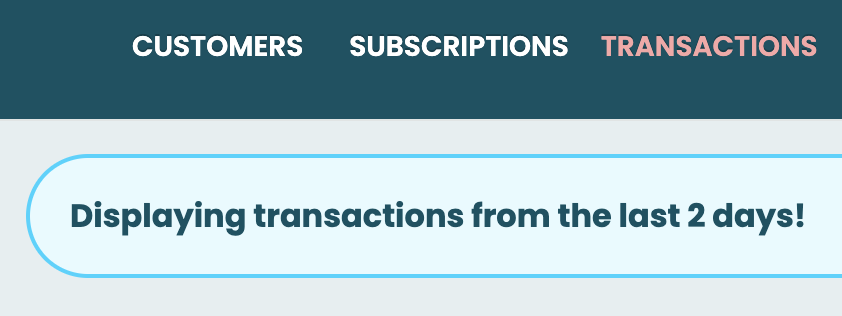

In the Vendo platform, the Sales > Transactions section defaults to showing results from the past two days. This is the only section where this limitation is applied, and a message at the top states: "Displaying transactions from the last 2 days!"

This setup is designed to speed up the platform’s performance when returning results. Merchants should keep in mind to adjust and extend the date filter as needed to view transactions outside this default range.

Simplifying Transaction Tracking with Vendo’s Color-Coded System

In Vendo's Back Office, the Sales > Transactions tab offers a streamlined view of transaction statuses, utilizing color-coded indicators for quick reference:

- Green: Successful transactions.

- Red: Rejected transactions, with specific error details provided.

- Orange: Transactions currently processing.

- Gray: Transactions that do not fall into the above categories.

While these color codes provide an immediate understanding of transaction statuses, it's also important to consider the transaction type for a better understanding. This approach ensures a thorough assessment of each transaction's nature and status.

For more detailed information, refer to Vendo's documentation on transactions.

Currency Conversions in Vendo

In Vendo, all offer calculations are initially based on USD, regardless of the currency displayed to the customer. The system uses a specific conversion rate, known as the Display Rate, to convert the USD amount into the local display currency. After conversion, the resulting amount could be rounded for consistency and customer-friendly pricing. Rounding is optional and can be configured.

Even when offers are displayed in European regions or zones, the reference currency remains USD. This ensures consistency across the platform, regardless of the displayed or local currency.

Merchants can manage their offers and pricing easily through the Vendo Backoffice while trusting the system to handle precise and transparent currency conversions.

Reporting differences between subscription models and S2S

Merchants can access four different reports in the Data Tools section, each designed with a specific goal in mind. The treatment of the two business models—Subscription and S2S (Server-to-Server)—differs across these reports.

Key Differences Between the Models:

- Subscription Model:

- Payments lead to the creation of a membership.

- Vendo has visibility into transaction types (initial and rebill) and manages cancellations and expirations of subscriptions.

- S2S Model:

- Vendo processes payments only.

- Vendo does not manage or track rebills, cancellations, or expirations.

Reporting Overview in Vendo Data Tools (VDT):

- Sales & Revenue Section:

Reports sales count and gross revenue (in USD) for both models. - Membership Section:

Reports only on the Subscription Model, as memberships are not tracked in S2S. - Risk Section:

Provides reporting for both models, focusing on fraud and other risk metrics.

Other reports:

- Simple Report, VAT, and Payments:

Includes data for both models.

Updated 4 months ago